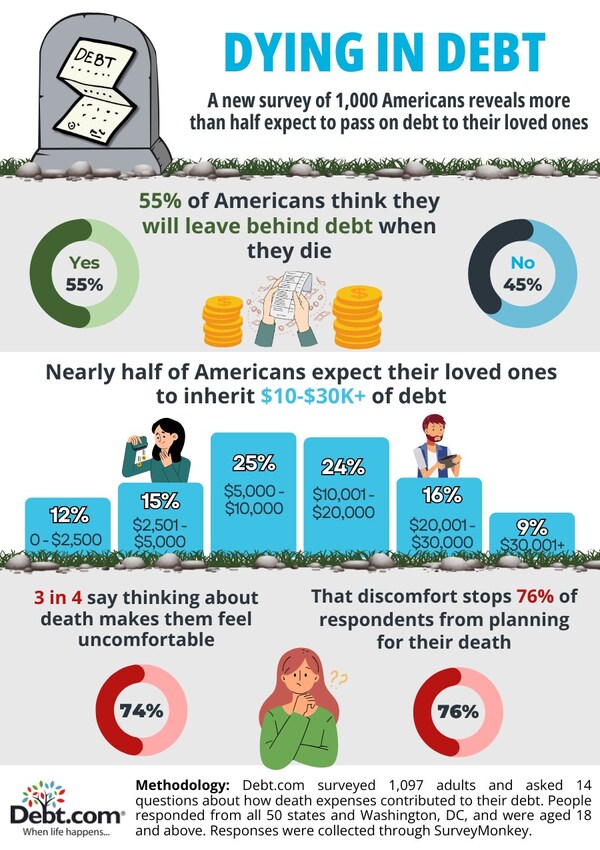

Debt.com Survey Reveals Majority of Americans Anticipate Leaving Debt Behind for Loved Ones

FORT LAUDERDALE, Fla., Nov. 25, 2024 /Noticias Newswire/ – A new survey conducted by Debt.com highlights a concerning trend: over half of Americans believe they will leave debt to their loved ones after passing away, with many estimating the amounts to be in the tens of thousands of dollars.

The survey, which polled 1,000 Americans, revealed that nearly half (48.66%) anticipate leaving behind debts ranging from $10,000 to over $30,000.

Breakdown of debt inheritance expectations shows:

- 11.58% believe loved ones will inherit $0 - $2,500 of debt

- 15.27% believe loved ones will inherit $2,501 - $5,000 of debt

- 24.50% believe loved ones will inherit $5,001 - $10,000 of debt

- 23.83% believe loved ones will inherit $10,001 - $20,000 of debt

- 15.77% believe loved ones will inherit $20,001 - $30,000 of debt

- 9.06% believe loved ones will inherit $30,001 or more of debt

Additionally, 70% of respondents said they would take on debt to cover a family member's funeral expenses, up from 55% in 2023. The survey further shows:

- 20% are willing to take on $2,001 - $3,000

- 18% are willing to take on $1,001 - $2,000

- 14% are willing to take on $501 - $1,000

Half of the participants reported taking on credit card debt after a loved one's death, with 37% saying it caused them significant anxiety. "Most Americans don't know which debts they inherit and which they don't," said Don Silvestri, president of Debt.com. "Death or planning for one's death isn't confusing; it's just uncomfortable, so many of us avoid it entirely." The survey found that 74% of respondents are uncomfortable thinking about death, and 76% say this discomfort prevents them from planning for it. Only 41% of respondents have a written will, and just 33% have final expense insurance.

The survey also indicates that Gen X is the generation most likely to expect they will leave debt behind when they die, followed by Millennials and Baby Boomers.